Top Advantages of Financial Debt Combination for Managing Your Funds: More Discussion Posted Here

Top Advantages of Financial Debt Combination for Managing Your Funds: More Discussion Posted Here

Blog Article

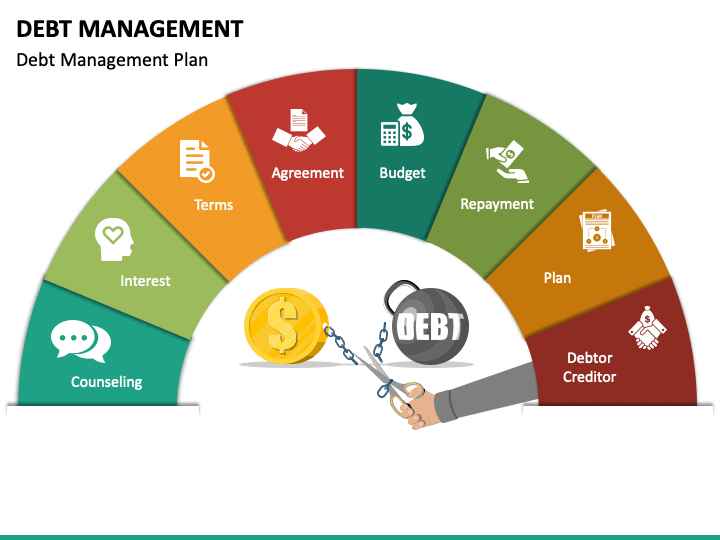

Comprehending the Trick Advantages of Carrying Out a Financial Obligation Management Prepare For Financial Stability and Safety

Boosted Financial Organization

A budget plan offers as a roadmap for financial decision-making, enabling individuals to track their investing, identify locations for prospective financial savings, and allocate funds in the direction of essential expenditures, cost savings, and debt repayments. Budgeting enables individuals to establish practical financial objectives, whether it be constructing an emergency fund, saving for a major purchase, or paying off financial obligation.

By maintaining track of expenses, account declarations, and vital monetary info in an organized manner, individuals can quickly check their financial progress, recognize discrepancies, and make informed choices. Ultimately, boosted monetary organization via budgeting and record administration lays a solid structure for economic security and success.

Reduced Rate Of Interest

By tactically working out with financial institutions and checking out refinancing choices, individuals can function towards safeguarding lowered interest prices to increase and relieve monetary worries financial debt payment. Minimized passion rates play a critical function in making financial obligation much more convenient and cost-efficient for people looking for financial security.

Additionally, lowered rate of interest can bring about considerable long-lasting cost savings, particularly on high-interest debts like credit rating cards or personal car loans. By settling financial debts or discussing lower rates with creditors, individuals can reduce their total cost of borrowing, ultimately improving their monetary health. Additionally, reduced rate of interest rates can assist people avoid dropping even more into debt, as high-interest settlements can frequently impede progress in removing existing financial obligations. Overall, securing lowered rates of interest through a debt administration strategy can offer individuals with a more sustainable course in the direction of economic safety and debt flexibility.

Consolidated Debt Settlements

Consolidated debt repayments streamline economic commitments by integrating numerous debts into a single workable payment, streamlining the payment process and possibly decreasing total rate of interest expenses. This strategy can provide individuals with a more clear overview of their monetary commitments, making it much easier to spending plan and plan for payments. By combining debts, individuals can commonly profit from lower rate of interest prices, particularly if the brand-new consolidated car loan has a lower average rates of interest compared to the individual debts. This can cause significant long-lasting savings by decreasing the overall amount paid in rate of interest over the life of the lending.

Furthermore, combined financial obligation settlements can assist enhance credit scores by guaranteeing constant and timely settlements. Generally, consolidated debt repayments offer a practical and effective means for people to manage their financial debts, decrease financial tension, and work towards accomplishing higher economic stability and safety.

Specialist Financial Guidance

Navigating the complexities of economic management usually requires looking for expert advice to ensure enlightened decision-making and tactical planning for long-lasting security and success. Professional monetary support can offer individuals with the proficiency and assistance needed to navigate tough monetary circumstances properly. Financial experts or counselors can supply customized guidance based upon a person's particular circumstances, helping them comprehend the implications of their economic choices and charting a course in the direction of monetary security.

One key advantage of specialist economic guidance is the access to customized monetary techniques. More Discussion Posted Here. These experts can assess a person's economic scenario, create an extensive strategy to attend to financial debt management problems, and supply recurring assistance and tracking. In addition, economists can supply understandings on budgeting, saving, and investing, equipping individuals to make audio monetary selections

Improved Credit Scores Rating

Looking for professional monetary guidance can play an important role in improving one's credit report and try here general financial health and wellness. When executing a financial debt administration strategy, individuals can experience a favorable effect on their credit report. By working with economists, people can discover effective strategies to handle their debts sensibly, make timely repayments, and negotiate with creditors to possibly lower rate of interest or forgo charges. These actions not only aid in lowering financial obligation but additionally in developing a much more positive credit report.

A debt monitoring plan can likewise aid in combining several financial obligations right into one manageable regular monthly settlement, which can you can look here avoid missed payments that adversely impact credit rating - More Discussion Posted Here. In addition, by adhering to the structured settlement plan described in the financial obligation monitoring program, individuals can show monetary duty to credit report reporting agencies, bring about progressive renovations in their credit history with time

Verdict

In verdict, carrying out a financial obligation management strategy can offer enhanced economic organization, decreased interest rates, combined financial debt payments, professional financial support, and boosted credit rating. By complying with a structured plan, people can much better manage their debts and work towards financial stability and protection. It is very important to take into consideration the advantages of a financial obligation management strategy in order to boost one's general monetary well-being.

In general, combined financial obligation repayments provide a reliable and functional method for individuals to handle their financial debts, decrease monetary tension, and work in the direction of attaining higher monetary security and security.

Professional financial advice can provide individuals with site here the experience and assistance needed to browse tough financial situations properly. Financial advisors or therapists can use customized guidance based on a person's specific situations, assisting them comprehend the implications of their monetary decisions and charting a path towards monetary security.

In addition, financial specialists can provide understandings on budgeting, saving, and investing, encouraging people to make audio financial selections.

In conclusion, executing a financial obligation administration plan can provide enhanced economic company, minimized rate of interest rates, consolidated financial obligation settlements, expert monetary support, and boosted debt score.

Report this page